Best solution we offer you

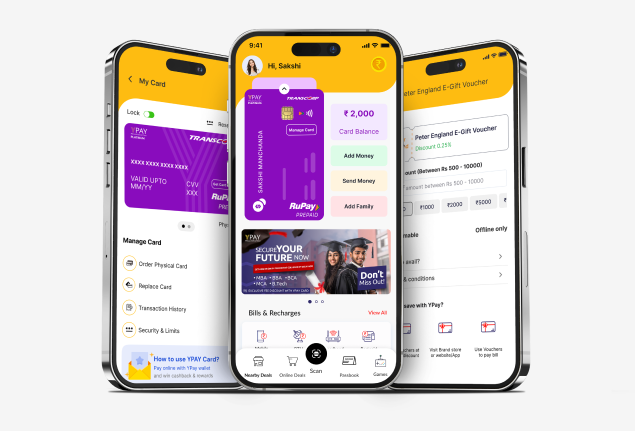

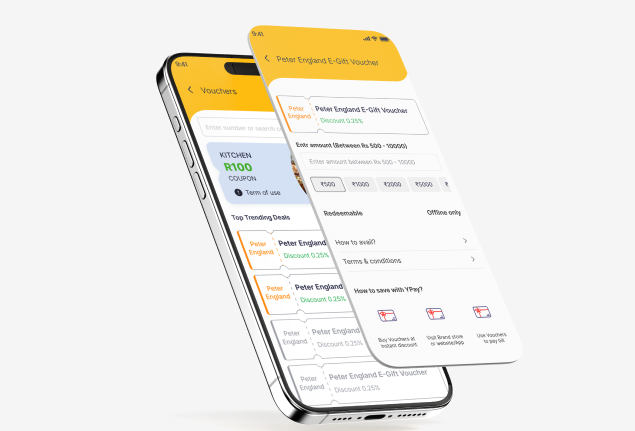

Welcome to YPay Card!

Your Pocket Money, Your Way!

Learn and Grow

Your Path to Financial Independence

YPay Card isn’t just about spending; it’s about learning! Our app provides tips and resources on saving, budgeting, and responsible spending to empower you on your financial journey.

About YPayCheck our Work

Join the YPay Community!

Testimonials

Happy Customer Feedback

We love our client and our clients

loved us.

Earlier I was a bit skeptical about my daughter using this card. But now after a few weeks, more than her I’ve come to love it. Its ease of use and safety have been a huge plus.

Dhiraj

ParentI’d recommend this card to every parent who wants their kid to value money. It’s heartening to see my son save for things that earlier he’d ask us to buy for him. This power of feeling financially independent has really helped him become more responsible.